Getting My Fortitude Financial Group To Work

Getting My Fortitude Financial Group To Work

Blog Article

Fortitude Financial Group for Beginners

Table of ContentsSee This Report about Fortitude Financial GroupOur Fortitude Financial Group PDFsFascination About Fortitude Financial GroupFortitude Financial Group for BeginnersThe Best Strategy To Use For Fortitude Financial Group

Note that numerous experts will not manage your properties unless you fulfill their minimal demands. When choosing a monetary advisor, find out if the private adheres to the fiduciary or suitability standard.The wide area of robos spans systems with access to monetary experts and investment management. If you're comfortable with an all-digital platform, Wealthfront is an additional robo-advisor option.

Financial consultants might run their own firm or they may be part of a bigger office or bank. No matter, an advisor can help you with every little thing from building a monetary strategy to investing your cash.

Fortitude Financial Group Can Be Fun For Everyone

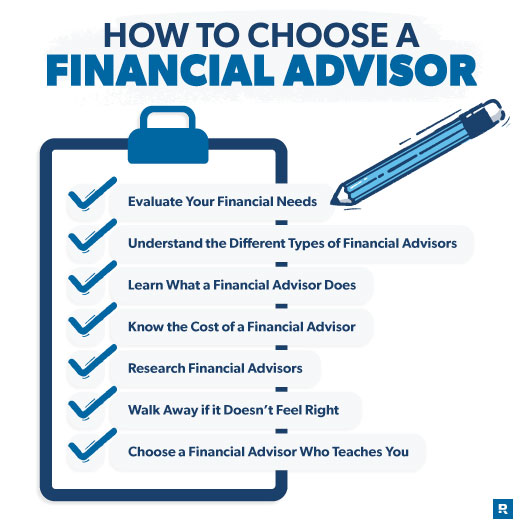

Consider working with a economic expert as you develop or modify your financial plan. Finding a monetary expert doesn't have to be tough. SmartAsset's free tool suits you with approximately 3 vetted monetary advisors who offer your area, and you can have a free introductory call with your advisor matches to choose which one you really feel is appropriate for you. Inspect that their credentials and skills match the solutions you want out of your advisor. Do you desire to learn even more concerning monetary consultants?, that covers concepts surrounding accuracy, reliability, editorial freedom, expertise and objectivity.

Many people have some psychological link to their cash or the things they acquire with it. This psychological link can be a primary factor why we might make inadequate monetary choices. A specialist monetary advisor takes the feeling out of the formula by offering objective suggestions based on understanding and training.

As you go via life, there are monetary decisions you will make that could be made extra quickly with the support of a professional. Whether you are attempting to reduce your financial obligation lots or intend to start preparing for some long-term goals, you might take advantage of the solutions of a monetary consultant.

Fortitude Financial Group Fundamentals Explained

The fundamentals of financial investment administration include buying and marketing financial properties and other investments, however it is a lot more than that. Handling your financial investments involves comprehending your short- and long-lasting goals and making use of that info to make thoughtful investing decisions. A financial advisor can supply the information required to help you expand your investment portfolio to match your preferred level of threat and meet your monetary goals.

Budgeting offers you an overview to just how much cash you can spend and just how much you ought to conserve each month. Following a spending plan will certainly aid you reach your brief- and long-term monetary goals. A monetary consultant can help you outline the activity steps to require to set up and preserve a budget plan that helps you.

Often a medical bill or home repair can suddenly include in your debt lots. A specialist financial obligation monitoring strategy helps you settle that debt in one of the most economically useful method feasible. An economic expert can aid you evaluate your financial debt, prioritize a financial debt settlement method, offer options for financial debt restructuring, and describe an all natural plan to better take care of financial obligation and satisfy your future financial objectives.

The Of Fortitude Financial Group

Personal capital analysis can tell you when you can afford to purchase a brand-new car or just how much cash you can include to your financial savings each month without running short for essential costs (St. Petersburg, FL, Financial Advising Service). A financial advisor can aid you plainly see where you spend your cash and then use that understanding to help you comprehend your economic health and exactly how to boost it

Danger management services recognize prospective dangers to your home, your vehicle, and your household, and they assist you place the appropriate insurance plan in area to mitigate those dangers. A monetary consultant can help you develop a method to secure your earning power and lower losses when unforeseen points take place.

The smart Trick of Fortitude Financial Group That Nobody is Talking About

Reducing your tax obligations leaves more cash to add to your investments. Investment Planners in St. Petersburg, Florida. see here An economic advisor can assist you use charitable providing and investment strategies to decrease the amount you must pay in tax obligations, and they can show you just how to withdraw your cash in retirement in such a way that additionally reduces your tax obligation problem

Also if you really did not begin early, college preparation can assist you put your child via university without dealing with suddenly huge expenses. A monetary advisor can assist you in recognizing the most effective methods to save for future college expenses and just how to money possible voids, clarify how to minimize out-of-pocket college expenses, and advise you on eligibility for financial assistance and gives.

Report this page